All About FHA Loans

This article will explain what an FHA loan is, how it works, FHA loan requirements, qualifications, and everything you need to know, including the next steps to determine if this is the right loan option for you, and how to get pre-approved for an FHA loan.

FHA Loans: Everything You Need To Know About This Affordable Homeownership Option

FHA loans are a popular mortgage option among home buyers because it offers loan options to people with a wider range of financial backgrounds, making homeownership accessible to more people. If you’re wondering if an FHA loan is right for you, contact us and we will get you in touch with a loan officer who can help you find the best mortgage loan for your goals! Keep reading for more information.

What is an FHA loan and how does it work?

A Federal Housing Administration loan, also commonly known as an FHA loan, is a type of mortgage loan that is insured by the Federal Housing Administration (FHA) - which is a government agency.

The Federal Housing Administration is a part of the U.S. Department of Housing and Urban Development (HUD). FHA provides mortgage insurance that protects lenders against losses. Losses may or may not include the property owner defaulting on their mortgage, and having the FHA mortgage insurance helps lenders take on less risk, therefore being able to offer more mortgages to more homebuyers.

Check out this article for more information on the history of the Federal Housing Administration.

Do FHA loans have fixed interest rates?

FHA offers a variety of fixed and variable interest rates. Make sure to discuss the difference with your loan officer, and which option best fits your situation.

Does FHA require PMI (Private Mortgage Insurance)?

FHA requires MIP, which stands for Mortgage Insurance Premium. This is slightly different from PMI, but very similar.

With MIP, the borrower pays this each month to protect the lender in case of default on the loan. This is required on all FHA loans, and does not vary based on credit worthiness.

FHA Loan Myths & Misconceptions

There is a lot of misinformation about FHA loans.

Some people think FHA loans are only for people with low credit scores or no credit scores. While that can sometimes be true, the reality is an FHA loan is for anybody who’s specific situation it makes sense for.

Another common myth about FHA loans is that they are harder or more difficult to work with throughout the home buying process than other loans. FHA loans are not more difficult than other loans, and in some cases, can be more simple!

These are just a few examples, but a consumer should always compare an FHA loan to other loans, and see if it makes sense for them. The best way to do that is by talking to a loan officer who can help you look at the whole picture to determine the best loan type and program for you.

Why do sellers avoid FHA loans?

In a very active, aggressive housing market, some sellers might be advised by the agent they are working with to avoid accepting an offer that has FHA financing. Unfortunately, this is due to unknowns with the property, and the listing agent and seller choosing what they feel is the “path of least resistance.”

FHA loans require the property to be in safe, livable condition. There is a chance that an appraiser might request repairs to be done to meet FHA guidelines. In this situation, the buyer and seller would work to get the repairs done prior to closing, and then the appraiser would go back out to the property to confirm the work and repairs have been completed. This process can take as little as 1-2 days to complete.

Why do people prefer FHA loans?

Many people prefer FHA loans because a lot of times they will have more aggressive interet rates. Some buyers like the idea of only needing 3.5% for their down payment. Along with other reasons, FHA loans allow for lower credit scores as well.

Are FHA Loans always 3.5% down?

No. The minimum down payment for an FHA loan is 3.5%.

However, some situations require a higher down payment. There are also down payment assistant options, at which point the borrower is not responsible for the 3.5% down payment.

Every situation is different and unique, so it’s best to talk to a loan officer to understand the amount you will need for a down payment, regardless of what type of loan you’re looking at.

FHA Loan Requirements

There are certain requirements that do need to be met to obtain an FHA loan. Some are standard requirements for most, if not all, loan types. Some requirements are specific to FHA loans.

Aside from that, there are many different types of FHA loans, and some requirements, such as loan limits, may vary depending on the location of the property. You can use an FHA loan to either buy a house or refinance an existing mortgage loan.

FHA Loan Qualifications for Borrowers

As we’ve already briefly covered, there are may different types of FHA loans, and each one will have their own specific set of qualifications. However, you can typically expect the following FHA loan requirements:

Credit score of 500 or higher

3.5% - 10% downpayment (Down payment assistance is available). The minimum down will depend on other factors.

Proof of steady income and consistent employment

Ability to pay the Mortgage Insurance Premium (MIP) which varies based on the loan amount

Specific home inspection standards, which tend to be higher standards than a conventional loan may require

The loan must be for a property that will be your primary residence

The best way to determine if you will qualify for an FHA loan is to contact a loan officer who can look at your individual financial picture and help you find the best loan that meets your needs and goals (whether that be an FHA loan or a different type of loan).

FHA Loan Limits

The loan limit, or maximum loan amount, varies for all counties and states. The loan limits may also change from year to year. For the most up to date information, you can visit this page on the U.S. Department of Housing and Urban Development website, or contact us and we’ll get you in touch with a loan officer who can help you understand the loan limit based on the type of FHA loan you may be looking at and your county and state.

FHA Loans and Bankruptcy

It’s still possible to obtain a mortgage if you have filed for bankruptcy, and that includes being able to get an FHA loan. When it comes to FHA loans and chapter 7 bankruptcy, it must be 2 years since the date of the discharge. If you are currently in chapter 13 bankruptcy, and you have made at least 12 timely payments, you might qualify for an FHA loan.

Types of FHA Loans

There are multiple different types of FHA loans to address different situations and needs.

For a purchase, there are standard FHA loans, Energy Efficient, Rehabilitation, and Disaster Victim loans. It’s also possible to get an FHA loan on a new construction home.

For a refinance, there are rate/term, washout, and Streamline Refinance.

There is also down payment assistance available for FHA loans. Make sure to discuss with your loan officer which loan best fits your needs! We’ll give some additional details about popular types of FHA loans below.

FHA Loans for First-Time Home Buyers

FHA loans can be great for first-time home buyers, so much so that a lot of people consider an FHA loan to be a “first-time home buyer loan,” but that is not a requirement to qualify. FHA loans are not strictly for first-time home buyers.

In fact, you can utilize an FHA loan no matter how many homes you’ve purchased in the past, as long as you qualify in all other aspects.

FHA Investment Property Loans

An FHA insured mortgage is for primary residences ONLY.

However, FHA does allow the purchase of a 2-4 unit residential property, as long as the purchaser will owner-occupy one of the units. This is commonly known as house hacking, and is a great opportunity for someone that doesn’t want to put 15% - 25% down on a 2-4 unit property. FHA would still possibly require as little as 3.5% down.

House hacking is where you buy an investment property and live in one of the units, using the rent from the other unit(s) to help pay the mortgage, pay for repairs or updates, etc.

FHA Loans on Manufactured Homes

FHA loans are allowable on manufactured homes. However, there are very specific requirements that need to be met. Please consult your loan officer to make sure that the specific property you are interested in meets FHA guidelines.

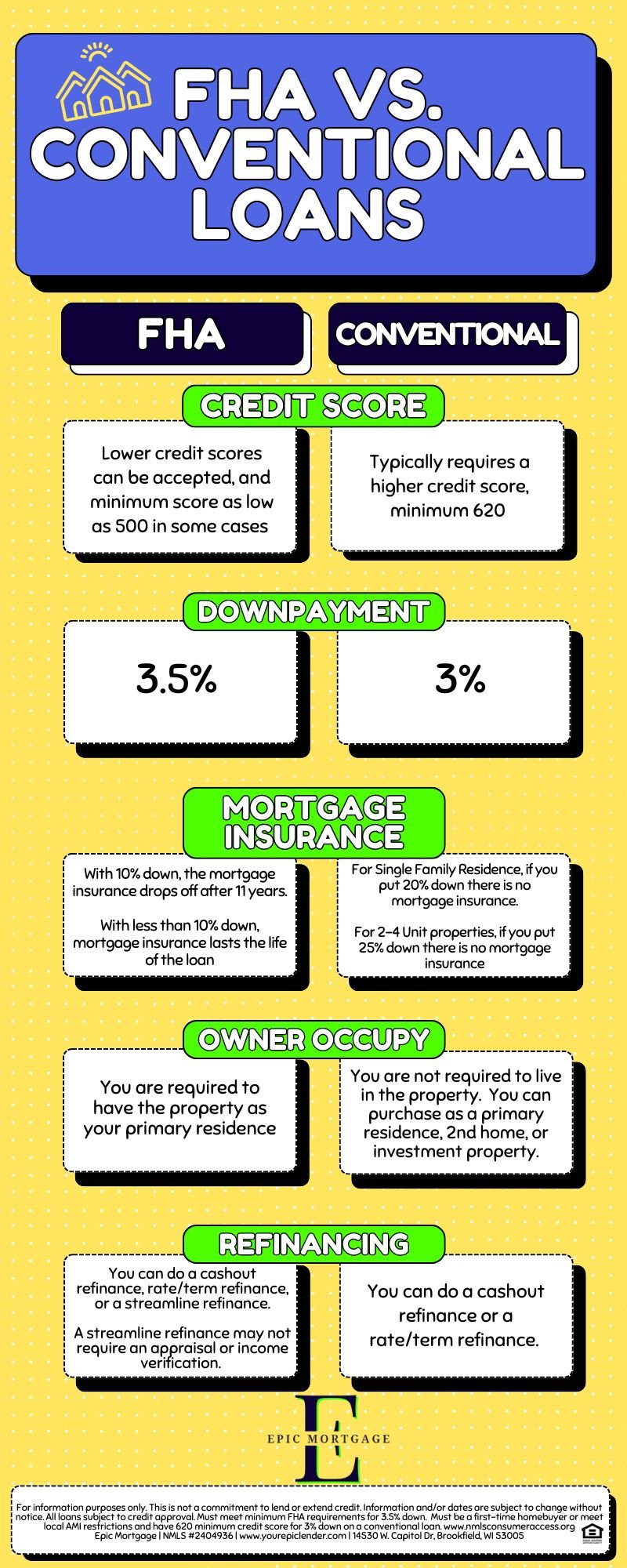

FHA Loan vs. Conventional Loan

There are a few key differences between an FHA Loan and Conventional Loan.

First, the credit score requirements are different for each of these loans. With an FHA loan, a lower credit score can be accepted, in some cases as low as a 500 can qualify. Whereas with a Conventional loan, the minimum credit score is 620.

Another notable difference is mortgage insurance. The FHA loan requires Mortgage Insurance Premium, or MIP, on all loan types - regardless of downpayment, credit worthiness, etc. A Conventional loan requires Private Mortgage Insurance, or PMI, but only if you put down less than 20%. If you put down less than 20%, you will pay PMI until 20% of the loan is paid off on a Single Family Residence. If you are looking at 2-4 unit properties, there is no mortgage insurance on a Conventional loan if you put down 25% or more.

Speaking of investment properties - you are required to owner-occupy the property as your primary residence with an FHA loan. As we’ve already discussed, this could be a good opportunity to house hack, as you can still use the FHA loan for an investment property as long as you are living in one of the unites. With a Conventional loan, you are not required to live at the property - meaning you can purchase it as a primary residence, second home, or investment property.

Last, when it comes to refinancing you have different options based on whether you get an FHA loan or Conventional loan. When you refinance a Conventional loan, you have the option to do a cashout refinance, or a rate/term refinance. Many times you will need an updated appraisal.

Refinancing with an FHA loan allows you to do a cashout refinance, rate/term refinance, or a streamline refinance. A streamline refinance may not require an appraisal or income verification.

FHA Loans - Frequently Asked Questions

-

There are many different types of FHA loans, and each will have their own set of qualifications. Typically you can expect the following:

Credit score 500 or higher.

3.5% - 10% downpayment, the minimum will depend on other factors.

Proof of steady income & consistent employment.

Ability to pay Mortgage Insurance Premium (MIP)

Specific home inspection standards.

The loan must be for a property that will be your primary residence.

-

Yes, while it. is not a requirement to qualify, many people consider an FHA loan to be a "first-time homebuyer loan." You can use an FHA loan no matter how many homes you've purchased in the past.

-

You can use an FHA loan for a 2-4 unit residential investment property only if you are living in one of the units as your primary residence.

-

Yes, it is possible to get an FHA loan on a home you are building.

-

Yes, FHA loans can be used for manufactured homes. However, there are very specific requirements that need to be met. Make sure you consult a loan officer to know that the specific property you are interested in meets FHA guidelines.

-

Yes, you can have 2 FHA loans simultaneously. However, there are specific requirements that need to be met in order to qualify. You will need to consult a loan officer for more information.

-

Yes, FHA loans are assumable. There are specific requirements that need to be met - consult a loan officer for specific details.

-

You may qualify for an FHA loan if you are 2 years since the date of discharge for their chapter 7 bankruptcy. If you are in chapter 13 bankruptcy and have made at least 12 timely payments you may qualify for an FHA loan.

Current Mortgage Rates for FHA

Rates change on a daily basis, and we’d love to give you an estimate based on your actual financial situation. Contact us to get connected with a loan officer who can give you more information based on your unique situation.

Wrapping Up - All About FHA Loans

An FHA loan is a great option that makes homeownership possible to more people. While there are different requirements for FHA loans vs other loan types, such as Conventional, an experienced Mortgage Loan Officer can help guide you to the right solution for you. It’s important to consult a mortgage loan officer - even if you are just asking questions and not quite ready to buy or get pre-approved. We’re here to find a solution that is tailored to your needs and make your homeownership dream a reality.

We hope this has been helpful for learning more information about FHA loans!